Some wire transfers might ask for an IBAN, which is a set of numbers that create a code for transfer in Europe. Chase bank SWIFT code for incoming wires: CHASUS33.In terms of policies and other things to know about Chase Bank wire transfers, you’ll likely need to know certain information to complete the transfer, such as the bank’s SWIFT code, bank address, and more. There are no limits to how much money you can receive through Zelle. If you’ve decided to use Zelle (as mentioned above, it’s integrated into the Chase app and Chase mobile banking), the transfer limit is currently $2,000 per day or $16,000 per month for personal Chase accounts the limits for Chase business accounts is $5,000 per day and $40,000 per month. If you have a Chase business account you can request a higher limit by contacting Chase bank credit card support. Currently, you can send as much money as you have in your account, or $100,000, whichever is less.

Wire Transfer Policies and Limits at ChaseĪre there wire transfer limits at Chase? Yes, and they’re actually quite high compared to other banks. Again, the ability to complete a transfer via Zelle or any other money transfer app depends on the bank of the recipient, how much you’re sending, and where the bank is located.

International incoming wire fee chase free#

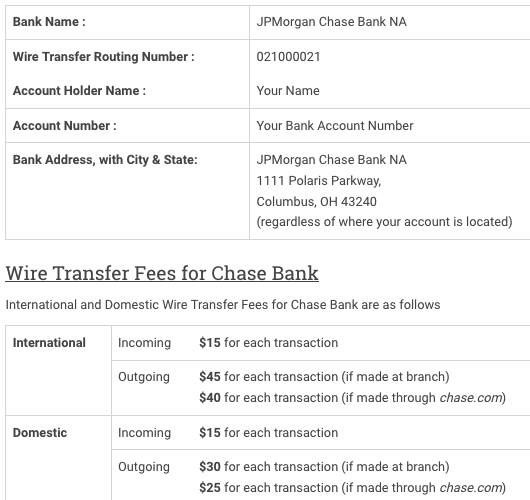

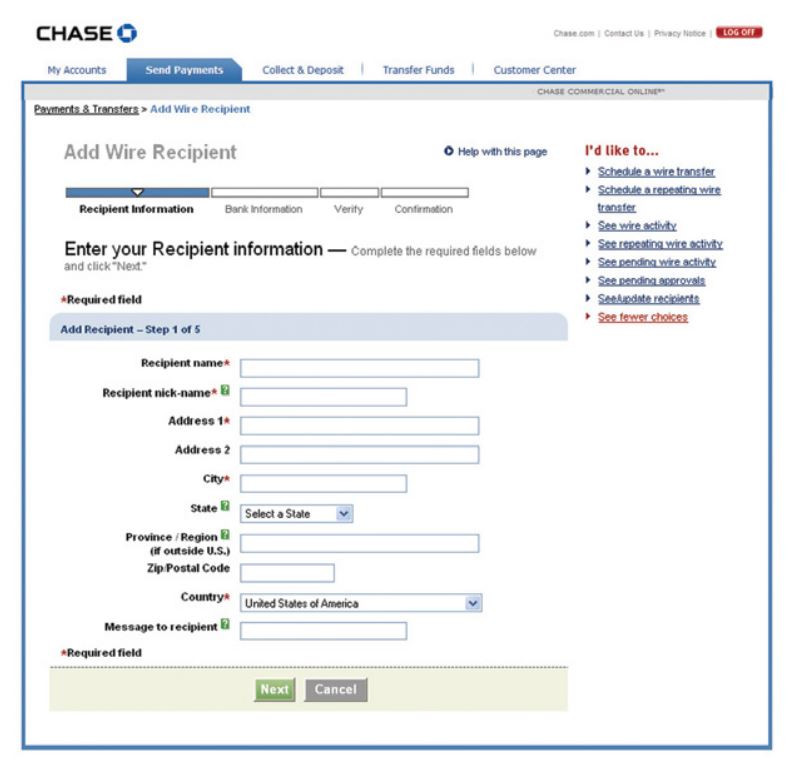

It’s free for most users (depending on the bank of the recipient) and is a great alternative to a traditional wire transfer. You can also transfer money with your Chase account by using Zelle, a money transfer app that’s integrated into the Chase online banking system. Chase outgoing domestic wire transfers that are performed in-person at a Chase branch will cost $35 per transaction.Chase outgoing domestic wire transfer fees are $25 per transaction.Chase incoming domestic wire transfer fees are $15 per transaction.Want to make a Chase Bank wire transfer to another account within the United States? It’s possible, and easy, especially if the recipient also has a bank account with Chase. If you visit a Chase branch in-person, international transactions are $50 each. And, it’s also important to note that the above-mentioned values are for online transfers. There are no wire transfer fees at Chase if you’re sending or receiving money either domestically or internationally between accounts at Chase. Online wires sent to a bank outside the US in foreign currency have no Chase Bank wire fee for amounts equal to $5,000 USD or more or only a $5 Chase Bank wire fee when less than $5,000 USD.Chase Bank outgoing foreign wire transfers sent in U.S.Chase bank's incoming foreign wire transfers are $15 per transaction.The Chase international wire transfer fee is: Like every other major bank, initiating or receiving a Chase Bank wire transfer incurs a fee. International Wire Transfer Fees at Chase And, there are almost always fees involved, both for incoming and outgoing transfers both internationally and domestically. Or, it can be done through a third-party money transfer service such as Western Union.

Depending on the banks that both the sender and the recipient use, it’s possible to initiate a wire transfer via the bank itself. Privacy Policy.To complete this transfer, you usually need the name of the recipient, their bank name, account number, and pickup details. Under which this service is provided to you. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2018Ĭable News Network. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

0 kommentar(er)

0 kommentar(er)